Introduction

A fast growing trend these days is to build an online marketplace, where other people sell their products / services through your channel. Site owners typically keep a commission for the sales.

This means the site needs to process payments from buyers, and then disperse those payments across all sellers / receivers that need their money.

There are a variety of ways this can be accomplished with PayPal, and it’s important to understand the differences. Let’s cover some of these important details.

PayPal Payouts

PayPal provides a feature called Payouts, which allows you to send payments to multiple people at one time.

This is used by many marketplaces to send payments to vendors selling on the platform. Buyers make payments to the marketplace platform, and then those payments are forwarded to the vendors (minus any fees and commissions).

This works well in general, but it has one major problem; liability.

With this model, all payments come to the marketplace first. This means that if buyers request refunds, file disputes with their bank or card provider, or file lawsuits, the marketplace is directly liable.

This can be a big problem, and it’s something that many don’t consider until they run into the problem, at which point it may be too late.

So What Are Payouts Good For Then?

Payouts are still a great feature that PayPal provides for those with specific requirements that fit the model.

For example, affiliate programs are a great use for Payouts. You may be tracking commissions you owe to hundreds or even thousands of affiliates referring people to you for sales.

In this case, it’s your product / service, and you would servicing your own customers anyway. You simply need to pay out to your affiliates.

This is a perfect use case for PayPal Payouts.

PayPal Parallel Payments

A parallel payment is different from a payout in that the marketplace will never touch the money.

With a parallel payment, the money is sent directly to the vendor that is actually selling the product / service. This means all liability sits with that person. If the customer files a dispute, it goes to them. Not the marketplace.

If you need to pay multiple vendors at one time and / or keep a commission for yourself, no problem!

You can include up to 10 receivers on a parallel payment, so you could pay 9 vendors and yourself a commission in a single transaction.

Each vendor gets paid directly. Each vendor pays their own PayPal fee based on their account’s rate. Each vendor would handle refunds or disputes directly with the buyer.

Conclusion

If you are running an online marketplace, I highly recommend you make sure you are not using Payouts. Instead, make sure you are using Parallel Payments.

This will remove all liability from you as the marketplace, and leave it up to the individual vendors to process refunds, handle disputes, and deal with general liability.

Looking for Live Help?

Schedule a live meeting with Drew Angell, PayPal Certified Developer, and get all of your questions or concerns answered.

Featured PayPal Products and Services

-

PayPal Support

$150.00 -

PayPal for WooCommerce

FREE! -

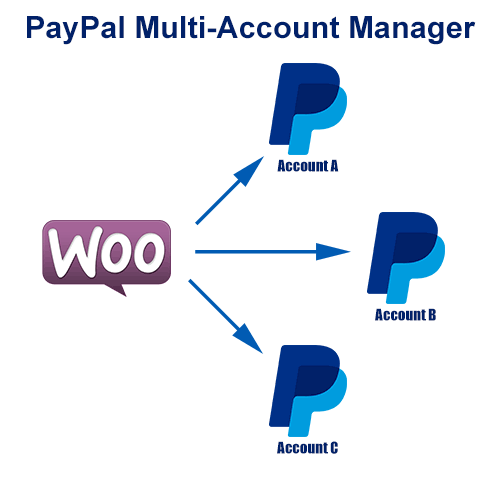

WooCommerce Multiple PayPal Accounts Plugin

FREE! -

PayPal Shipment Tracking for WooCommerce

$49.99 -

Offers for WooCommerce

$59.99 -

WordPress PayPal Invoice Plugin

$20.00 -

PayPal Webhooks for WordPress

$79.99 -

Sale!

PayPal IPN for WordPress

Original price was: $59.99.$49.99Current price is: $49.99.