Video Commentary

Introduction

You probably already know that PayPal is a tool for sending and receiving money. Whether you are buying or selling, you can process transactions with ease and peace of mind.

Did you know PayPal offers a lot more than simple payment processing? Not only will they help you move the money, but they will lend you money in a variety of different ways. Consider that for a moment.

If you’re selling, you can offer unique financing and “pay later” options to your buyers. If you’re buying you can take advantage of these offers for interest free credit lines.

We could talk about the wide variety of such services PayPal provides, but in this article I would like to specifically focus on just one; Buy Now Pay Later

Let’s discuss. You’re going to love it!

In Depth Overview

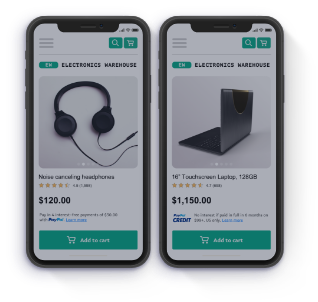

Give customers more ways to buy

Pay in 4 and PayPal Credit are included in PayPal Checkout, so you can start offering

customer financing immediately just by activating PayPal Complete Payments in our PayPal for WooCommerce plugin.

What Is Buy Now Pay Later?

So what exactly is this, and how does it relate to PayPal Credit?

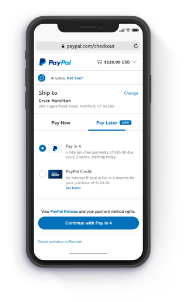

The simple answer is that Pay Later is an installment plan as opposed to a line of credit.

With PayPal Credit, much like a credit card, you carry a balance and you make payments towards this balance on a monthly basis. You can pay any amount you want as long (as long as you meet the minimum payment due) and once you have paid back the full balance you’re done.

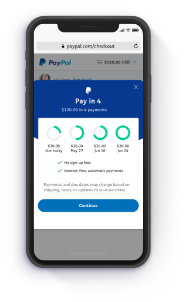

With Pay Later it works a little differently. Instead of carrying a line of credit, you simply spread the purchase price evenly across a number of months. These payments are the same amount each period, and continue until the entire original purchase price is paid. No interest!

Just think of the power of offering this to your website visitors. You get your full purchase price instantly, and your buyers get to spread it out to fit their budget more easily.

What is Pay in 4?

Pay in 4 is an interest-free installment solution included in PayPal Checkout along with PayPal Credit at no additional cost to you. It simply spreads the purchase price of an order over 4 even installments paid monthly.

Here’s How It Works

Show dynamic Pay Later messaging on your site.

With Pay in 4 and PayPal Credit, you can help customers buy what they need when they need it. After setup, dynamic messaging will display the most relevant Pay Later offer to your customers.

Your customer selects their best option

Flexible Pay Later options help your customers make their purchases today.

Customers get clear payment information

And there are no application fees for consumers and no additional costs for your business.

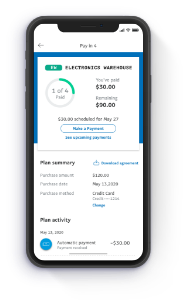

PayPal does the rest

Once the order is processed, you get paid up front, and PayPal takes care of collecting payments from your customers.

Merchant Benefits

As a store owner you want to provide as many payment options to your potential customers as possible. It’s never fun to see abandoned carts and lost opportunities.

By offering Buy Now Pay Later in your PayPal Checkout experience, you will typically see increased conversion rates as well as increased order totals.

This is because buyers are naturally more willing to pull the trigger (and spend a little more) when they are able to spread their order across multiple payments.

5 Reasons to Offer Pay Later

- 64% of consumers say that they are more likely to make a purchase at a retailer that offers interest-free payment options.

- 42% of merchants agree that buy now, pay later financing options help reduce shopping cart abandonment.

- 56% of consumers agree that they prefer to pay a purchase back in installments rather than use a credit card.

- 50% of consumers agree that they can manage their expenses better if they can buy some things now and pay for them later.

- 60% of millennial consumers agree that seeing a pay-over-time offer message early in the shopping experience gives them confidence that they will be able to pay for their purchase.

Data compiled from studies commissioned by PayPal and conducted by 3rd parties (Logica Research, Netfluential) in May and August of 2020.

The Trust Factor

- 79% of consumers aged 18-39 rate trust as the most important factor when paying online.

- 71% of consumers aged 18-39 are more likely to trust businesses that offer their preferred payment method.

- 28% of consumers aged 18-39 are more likely to shop at a merchant again if they offer a buy now, pay later option.

- 53% of consumers aged 18-39 trust PayPal to keep their financial information secure.

- 68% of Millennial and Gen Z online shoppers have used PayPal.

Online study commissioned by PayPal and conducted by Netfluential in November 2020 involving 1,000 US online shoppers aged 18-39.

A Win for Your Business

Increased Sales

Give shoppers more spending power and you can help boost your average order values.

No Added Costs

Pay Later offers are included in your existing PayPal rate.

Easy Promotion

Add dynamic Pay Later messaging to your site with a single integration.

NextGen Shoppers

Connect with active millennial and Gen Z PayPal shoppers around the globe.

Consumer Benefits

As a consumer it’s great to have options. Not only options for products and services, but options with the methods in which we pay for these products and services.

When making payments with PayPal there are many options available to you that can help you fit your needs and your budget.

Buy Now Pay Later is one of the many payment options available for you automatically when you make purchases using your PayPal account.

Simply choose the “Pay in 4” option during checkout, and PayPal handles the rest!

A Win for Your Customers

Flexible Payment

You get paid up front, while your customers pay later.

Trusted Brand

Rated most trusted brand across buy now, pay later providers.

Interest Free

With Pay in 4, your customers have an interest-free option to buy now and pay later.

Purchase Power

With the ability to spread payments over time, purchases can become more affordable.

Get Started

Are you using our PayPal for WooCommerce plugin? Are you comfortable adjusting settings on your own? Follow our guide to get up and running quickly!

Need More Help?

Could you use some additional guidance? Schedule an hour of Premium Support with Drew, and he’ll help you configure everything and answer all your questions.